If you’ve been following the world of cryptocurrency and decentralized finance (DeFi), you may have encountered the term “DeFi wallet”. But what exactly is a DeFi wallet? In simple terms, it is a crypto wallet that allows its users to store, transact, and manage their decentralized assets easily. But there is more to it than just being a storage tool. In this post, we will dive into the world of DeFi wallets and explore what they are, how they work, and why they are essential for participating in the growing DeFi ecosystem. So, let’s begin with the basics – what is a DeFi wallet?

Understanding DeFi: The Basics

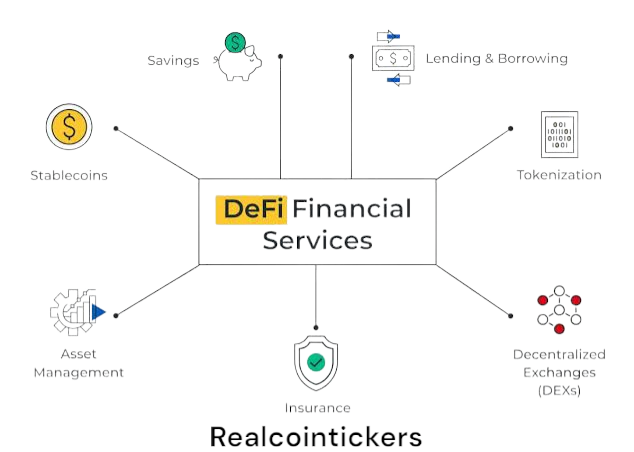

Decentralized finance, or DeFi, is a space that’s moving fast in the cryptoverse. It means using blockchain to redefine traditional banking systems and services in a decentralized and transparent way. Unlike traditional banks, DeFi is peer-to-peer, no intermediaries needed.

DeFi platforms allow you to borrow, lend, trade and invest in digital assets like crypto using smart contracts. Smart contracts are digital agreements that execute automatically based on the terms of the contract coded into the system. No more trust needed, no more intermediaries.

In the DeFi world, a DeFi wallet is an essential tool. It’s the bridge between you and the dApps you want to interact with. A DeFi wallet not only stores your digital assets securely but allows you to interact with different dApps seamlessly.

Understanding the basics of DeFi is key to understanding the importance of a DeFi wallet and how it fits into the bigger DeFi picture. In the next section we’ll dive deeper into DeFi wallets and their features. Stay tuned!

What is a DeFi Wallet?

A DeFi wallet is not just a regular digital wallet. It’s designed to take care of the DeFi ecosystem. A DeFi wallet is the gateway to interact with different dApps.

One of the key features of a DeFi wallet is that it stores digital assets securely. Unlike traditional wallets, DeFi wallets are non-custodial, you have full control of your funds. You can store and manage various decentralized assets like cryptocurrencies, tokens and NFTs.

But that’s not all. A DeFi wallet also allows you to interact with different dApps and do DeFi activities like borrowing, lending and trading. By connecting to the blockchain, the wallet allows you to make transactions and interact with smart contracts directly.

And many DeFi wallets have features like portfolio tracking, yield farming and staking. These extra features enhance the user experience and give you more ways to earn passive income.So there you have it. A DeFi wallet for anyone in the DeFi space. Now.

Advantages of Using a DeFi Wallet

DeFi wallets offer numerous advantages for users looking to participate in the decentralized finance ecosystem. One of the key advantages is the increased control and security over digital assets. Unlike traditional custodial wallets, DeFi wallets give users complete ownership and control over their funds. This means that users no longer rely on third-party intermediaries, reducing the risk of hacks or loss of funds.

Another advantage of using a DeFi wallet is interacting with various decentralized applications (dApps) seamlessly. With a DeFi wallet, users can easily access and utilize different DeFi protocols for activities such as borrowing, lending, and trading. This convenience eliminates the need for multiple wallets or accounts for each protocol, streamlining the user experience.

Additionally, DeFi wallets often provide features like portfolio tracking, yield farming, and staking. These features allow its users to maximize their returns and earn passive income by participating in DeFi opportunities. With the rising popularity of DeFi, having a DeFi wallet offers users the chance to stay ahead of the market and take advantage of new and exciting opportunities within the decentralized finance space.

In summary, the advantages of using a DeFi wallet include:

- Increased control and security over funds.

- Seamless access to various dApps.

- Additional features for optimizing returns.

By utilizing a DeFi wallet, users can fully engage in the growing DeFi ecosystem and make the most out of their digital assets.

How to Use a DeFi Wallet: A Step-by-step Guide

Using a DeFi wallet may initially seem daunting, but it’s pretty straightforward. Here’s a step-by-step guide to help you get started:

1. Choose a DeFi Wallet: There are various DeFi wallets available, each with its own features and security measures. Research and choose a wallet that best suits your needs.

2. Download and Install the Defi Wallet: Visit the official website of the chosen wallet and download the application. Follow the installation instructions given by the wallet provider.

3. Set up Your Wallet: Launch the wallet application and follow the prompts to set up your wallet. This usually involves creating a secure password, writing a recovery phrase, and confirming your identity.

4. Fund Your Wallet: Once your wallet is set up, you must transfer funds. This can be done by purchasing cryptocurrencies from an exchange or moving them from another wallet.

5. Explore the Features: Familiarize yourself with the wallet’s interface and features. Most wallets let you view your balance, send and receive cryptocurrencies, and interact with different DeFi protocols.

6. Connect to dApps: To use DeFi protocols, you must connect your wallet to the decentralized applications (dApps) you want to use. This usually involves selecting the dApp from a list within your wallet and permitting it to access it.

7. Execute Transactions: With your wallet connected to a dApp, you can perform various DeFi activities such as borrowing, lending, and trading. Follow the on-screen instructions within the dApp and confirm transactions using your wallet.

Remember to exercise caution when using your DeFi wallet. Keep your recovery phrase secure, regularly update your wallet software, and be cautious of phishing attempts. With these steps, you’re ready to explore the exciting world of DeFi using your own DeFi wallet. Enjoy!

Best Practices in Using a DeFi Wallet

When using a DeFi wallet, there are several best practices you need to follow to ensure the security and smooth operation of your wallet:

- Always keep your wallet software up to date. Developers always release updates at intervals to address security vulnerabilities and improve functionality, so it’s crucial to install them as soon as they become available.

- It’s crucial to keep your recovery phrase secure. This phrase is a backup for your wallet and should be stored offline safely. Never share it with anyone, and avoid storing it digitally, as this could make it vulnerable to hacks or theft.

- Be cautious of phishing attempts.

Always double-check the URLs and email addresses of websites and messages claiming to be from your wallet provider. By following these best practices, you can ensure a secure and hassle-free experience with your DeFi wallet.

Future of DeFi Wallets: What to Expect

As DeFi continues to grow, so will DeFi wallets. Here are the trends and developments to watch out for:

1. More Security: With more value stored in DeFi wallets, security will be king. Expect encryption, multi-factor auth and biometrics to keep your funds safe.

2. Interoperability: As DeFi grows, we’ll need better interoperability between wallets and protocols. So you can transfer assets and interact with multiple DeFi platforms without multiple wallets.

3. Centralized Finance (CeFi) Integration: The lines between CeFi and DeFi are blurring and we’ll see more integration. Expect partnerships between traditional financial institutions and DeFi wallets to make DeFi more accessible.

4. Better User Experience: User experience will be a focus for DeFi wallet devs. Expect more intuitive interfaces, features and personalized recommendations to cater to individual user needs.

5. Regulatory Compliance: As DeFi goes mainstream, regulators will impose rules and regulations. DeFi wallets will need to adapt to those to be compliant and provide a secure and transparent environment for users.

Overall the future of DeFi wallets looks good. With security, interoperability, user experience and regulatory compliance, these wallets will be key to the growing DeFi ecosystem. Stay tuned for more updates!

GIPHY App Key not set. Please check settings